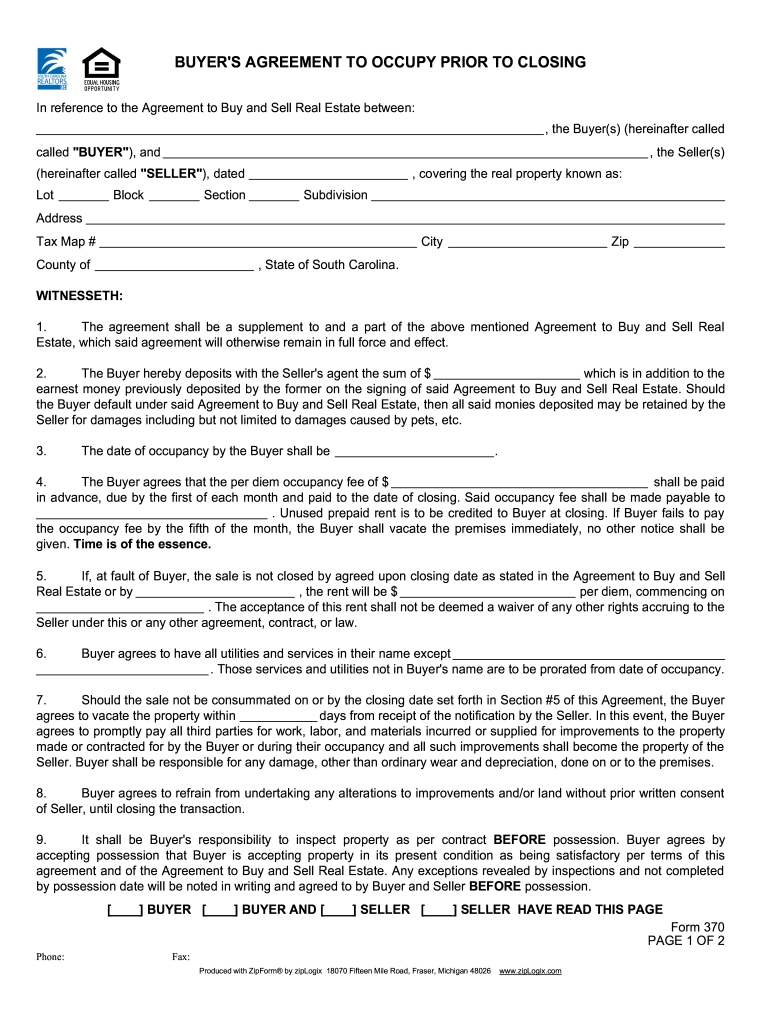

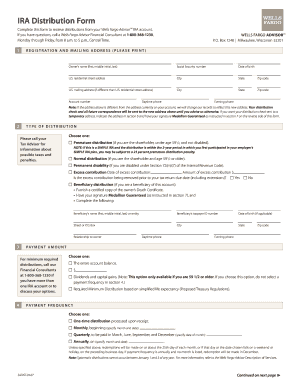

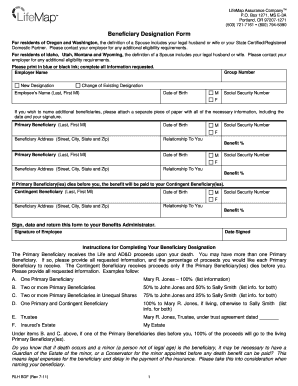

SC Form 370 2008-2024 free printable template

Get, Create, Make and Sign

Editing early occupancy agreement template online

SC Form 370 Form Versions

How to fill out early occupancy agreement template

How to fill out South Carolina form 370:

Who needs South Carolina form 370?

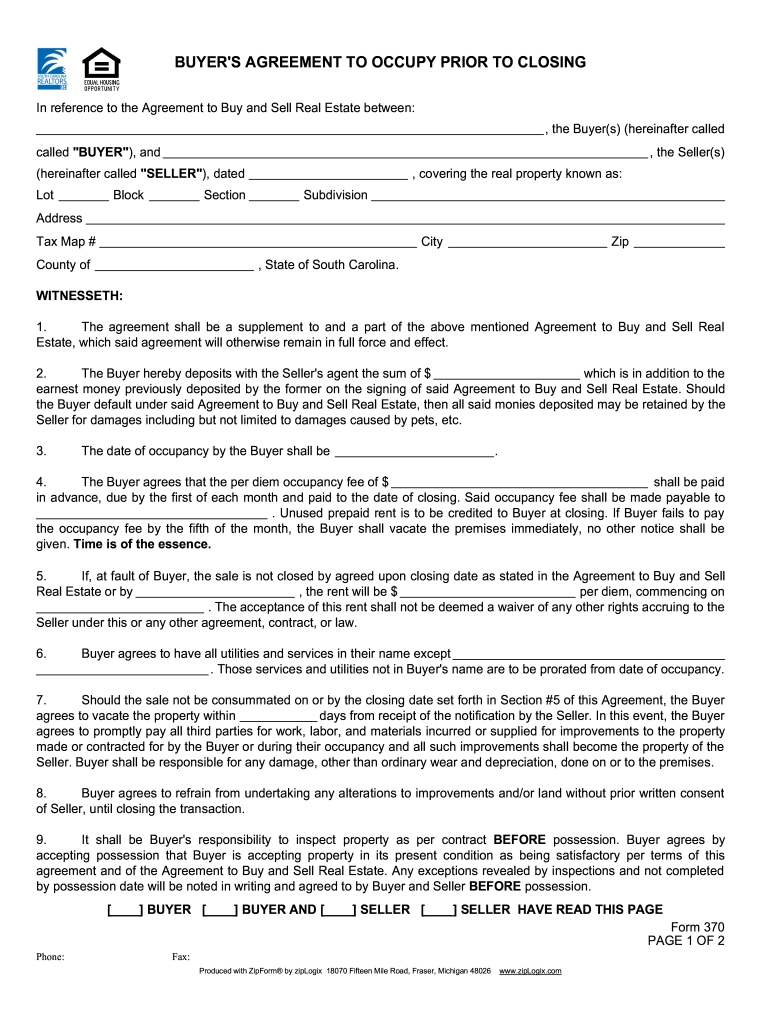

Video instructions and help with filling out and completing early occupancy agreement template

Instructions and Help about agreement occupy prior closing form

This week's contract tip has to do with temporary occupancy agreements for sellers after closing those of you that have followed my contract tips know that I am not a fan of a seller staying in house after the house no longer belongs to that person I firmly believe if at all possible that the seller should have vacated the property prior to closing to avoid any potential issues however that being said with the new CFPB tread guidelines in place and disclosure potential disclosure delays and things like that my opinion is there are going to be more sellers requesting temporary occupancy for a few days after closing more than we've seen in quite a long time that being the case make sure that you as an agent use the proper documentation to put everything in writing between the buyer and the seller namely that exhibit that you're going to use is the temporary occupancy agreement now depending upon which contract you are binding under which exhibit you use the GAR temporary occupancy agreement and the re forms temporary occupancy agreement are vastly different, so I want to point out those differences to you, I'm a couple of general guidelines or general considerations for you as an agent regardless if you are representing the buyer or the seller to keep in mind number one the seller if they are going to stay in the property after closing please have the seller check with their hazard insurance company because they will no longer have homeowners insurance on that property so somehow that that seller that person staying in the property after they no longer own it they might want to consider having some sort of insurance on their personal possessions number one for them being in the house, and it's something were to happen to them within the house while they are still there occupying the residents or when they are moved if they're moving a lot of times if you are moving and still own a home your homeowners insurance will cover any potential damage a moving company might have you know any damage to any property so if you are on the seller's side or on the buyer side that's definitely an issue to consider between the parties is making sure that the seller staying in the property after closing has some sort of insurance on their personal property items the other time the other issue is the time factor the amount of time that a seller should stay in a property after closing now check with the lender for the buyer needs to check with the lender because for a loan that a buyer is getting many loans have some stipulations on there that the borrower are getting the loan must actually occupy the property within a certain number of days so as not to have created a fraudulent loan, so that is definitely an issue to consider with the lender the buyer needs to check with the lender on number of days after closing that they have before they do have to occupy the property so now let me get to the specific exhibits the GAR exhibit is f 140 temporary occupancy...

Fill form occupy closing : Try Risk Free

People Also Ask about early occupancy agreement template

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your early occupancy agreement template online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.